does south dakota have sales tax on vehicles

Does South Dakota Have Sales Tax On Vehicles. If you have NEVER paid sales tax they will apply that 4 to the.

How Do State And Local Sales Taxes Work Tax Policy Center

Several examples of of items that exempt from South.

. South dakota does not have a corporate unitary or personal income tax. Motor vehicles registered in the State of South Dakota are subject to the 4 motor vehicle excise tax. What is the South Dakota sales tax rate.

The excise tax which you pay on vehicles in South Dakota is only 4. South Dakota collects a 4 state sales tax rate on the purchase of all vehicles. Instead you have to pay the sales tax rates of the state you reside.

In addition cities in South Dakota have the option of collecting a local sales tax of up to 3. South Dakota collects a 4 state sales tax rate on the purchase of all vehicles. The state sales tax rate in South Dakota is 4500.

Does South Dakota have vehicle tax. In addition to taxes car purchases in South Dakota may be subject to other fees like registration title and plate fees. 5 North Dakota levies a 5 sales tax rate on the purchase of all.

Sales Use Tax. Does South Dakota have sales tax on vehicles. The SD sales tax applicable to the sale of cars.

South Dakotas state sales tax rate is 450. The sd sales tax applicable to the sale of cars. South Dakota sales tax and use tax rates are 45.

The South Dakota sales tax rate is 4 as of 2022 with some cities and counties adding a local sales tax on top of the SD state sales tax. Mobile Manufactured homes. The State of South Dakota relies heavily upon tax revenues to help provide vital public services from public safety and transportation to health care and education for our.

For vehicles that are being rented or leased see see taxation of leases and rentals. Ian Fury a spokesperson for the governors reelection campaign said while the state sales tax. Car sales tax does not apply to trade-in vehicles in South Dakota.

If you want to buy cars South Dakota is among the top ten most tax. In other words be sure to subtract the trade-in amount from the car price before calculating sales tax. It is also the state your vehicle has to be registered in.

In the state of South Dakota sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Any company that does not have a physical presence in South Dakota is also required by law in South Dakota to get a South Dakota sales tax license and pay the relevant sales tax if it fits. What is ND sales tax on vehicles.

In addition for a car purchased in South Dakota. Noems proposal would fully eliminate the 45 state sales tax at the grocery store. Most major cities only collect an extra 2.

South Dakota Form 2290 Heavy Highway Vehicle Use Tax Return

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)

States That Do Not Tax Earned Income

S Dakota Counties Denied Sales Tax Power To Help Fund Money For Jails

Used Toyota Fj Cruiser For Sale In South Dakota Cargurus

Are There Any States With No Property Tax In 2022 Free Investor Guide

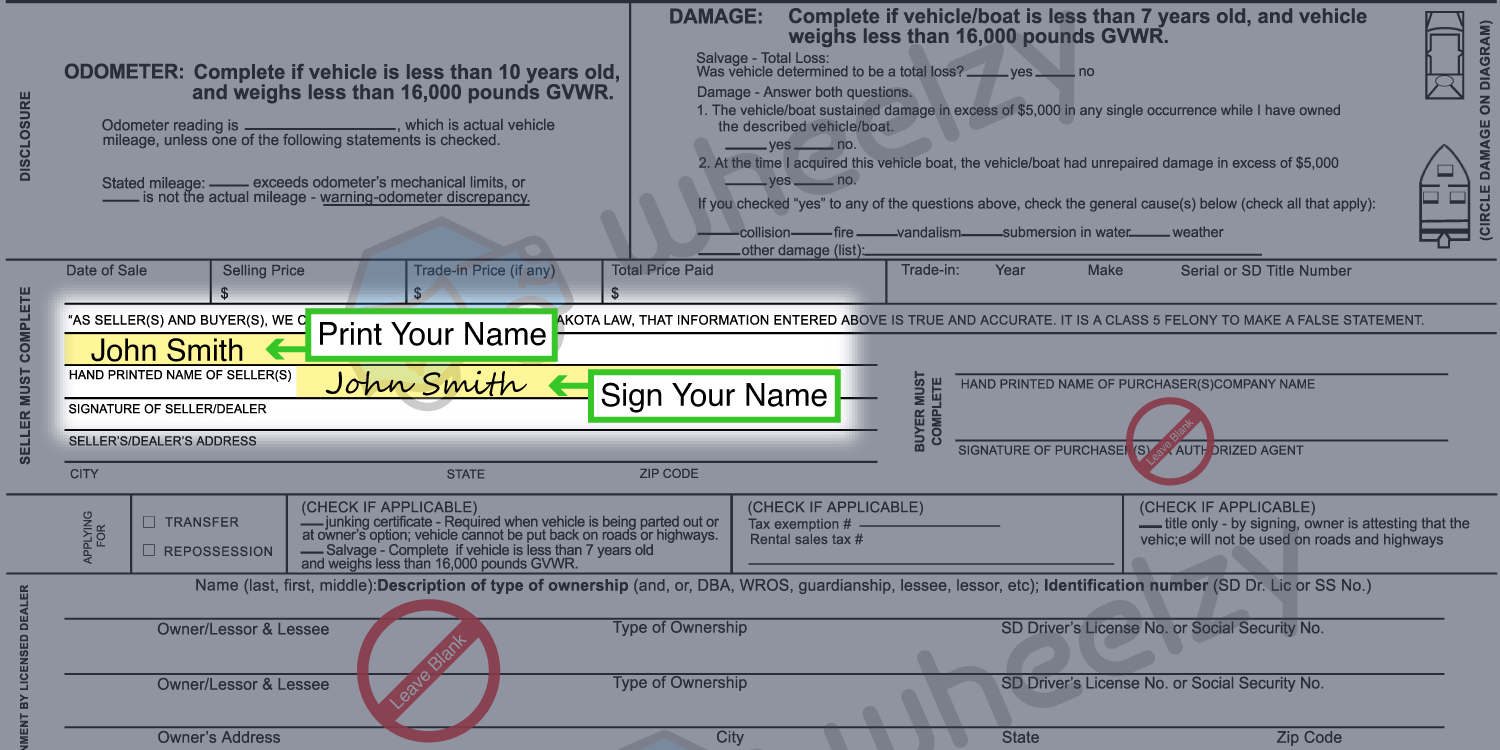

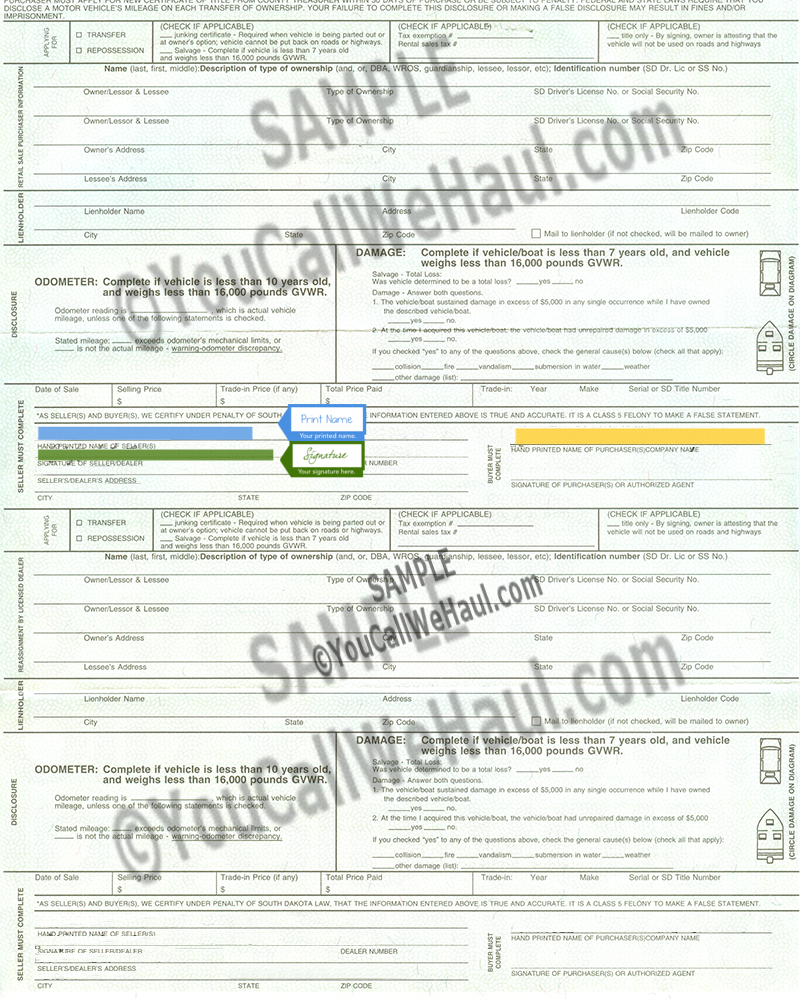

How To Sign Your Car Title In South Dakota Including Dmv Title Sample Picture

Colorado Sales Tax Rate Rates Calculator Avalara

States With No Sales Tax On Cars

South Dakota Income Tax Tax Benefits South Dakota Dakotapost

South Dakota Sees Bump In Sales Tax Revenue A Year After Wayfair Decision

Car Tax By State Usa Manual Car Sales Tax Calculator

South Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

How To Transfer South Dakota Title And Instructions For Filling Out Your Title

Sales Tax Laws By State Ultimate Guide For Business Owners

Sales Taxes In The United States Wikipedia

States With No Sales Tax On Cars

All Vehicles Title Fees Registration South Dakota Department Of Revenue

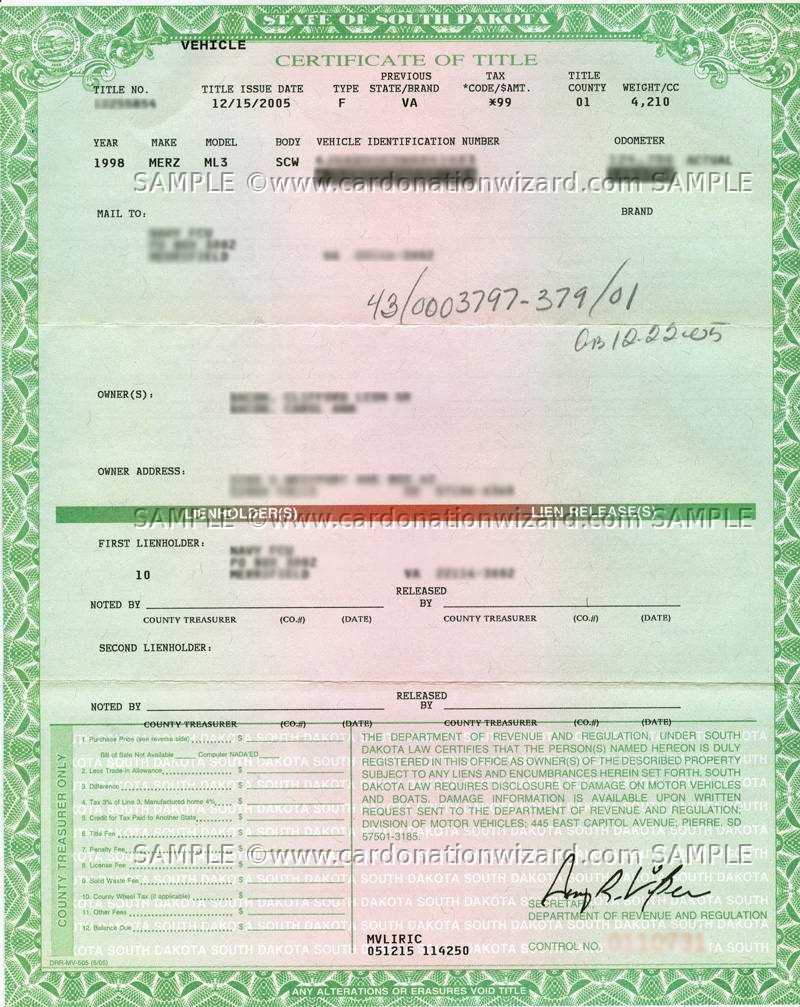

Car Donation South Dakota Support Sd Charities Car Donation Wizard Car Donation Wizard

All Vehicles Title Fees Registration South Dakota Department Of Revenue